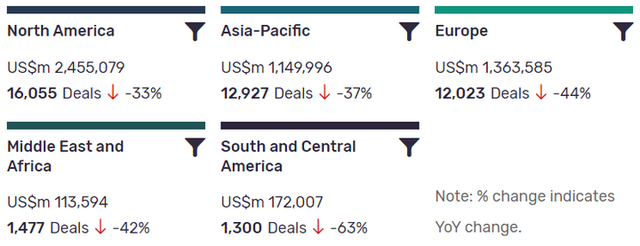

Deals activity by geography

Food industry deals, as captured by GlobalData’s Consumer Intelligence Centre, are down year-on-year (YoY) across all regions.

North America is leading in terms of deal value, but also recorded a significant decrease in YoY growth in deals volume at -33%. South and Central America has also suffered the biggest YoY change, with deal volumes at -63%, however in terms of deals value the Middle East and Africa, down 42% YoY, come last.

The volume of deals recorded by GlobalData also decreased YoY in Europe (-44%) and Asia-Pacific (-37%).

Deals activity by type

| Deal Type | Total Deal Value ($m) | Total Deal Count | YoY Change(Volume %) |

| Acquisition | 2420765 | 17171 | -13 |

| Asset Transaction | 597776 | 8626 | -53 |

| Venture Financing | 84374 | 5450 | -51 |

| Equity Offering | 430050 | 3802 | 0 |

| Private Equity | 429639 | 3011 | 18 |

| Debt Offering | 1072596 | 2410 | 86 |

| Partnership | 4034 | 2197 | 43750 |

| Merger | 116178 | 407 | -96 |

A breakdown of deals by type and volume shows mixed trends, with mergers down -96% and asset transactions down -53% YoY. Venture financing is down -51% and acquisitions are down 13%. Equity offering remanes unchanged YoY. However, private equity deals have seen an increase of 18%, debt offering deals are up 86%, YoY. Most notable, however, is the YoY change in partnerships, which are up 43750%.

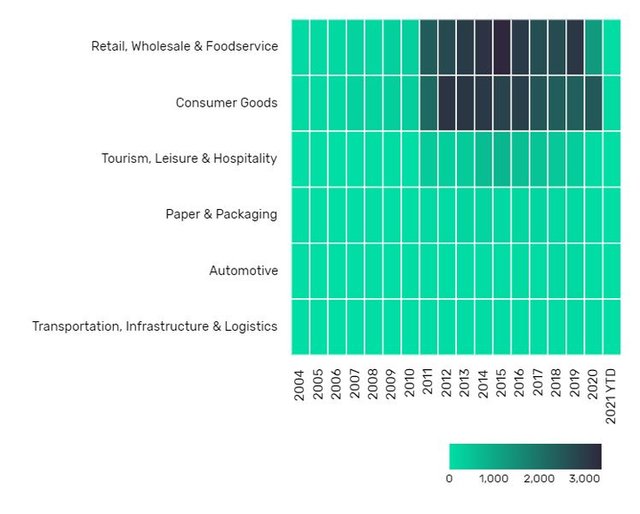

Deals activity by sector

The most notable development apparent in GlobalData’s analysis of food industry deals by sector is the decrease of deals across all sectors. Comsumer goods remained the leading sector by deals volume after several strong years of growth and remains relatively stable. Retail, Wholesail, and Foodservice saw the largest decline in its total volume, but is still is performing steadily compared to the rest.

Note: All numbers as of 21 January 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Consumer Intelligence Centre.

Latest deals in brief

Grab Holding Plans to Raise $2bn in Initial Public Offerings

According to Reuters, Grab Holdings Inc, a Singapore-based provider of an application that provides transportation, logistics, and financial services, has planned to raise $2bn in initial public offering (IPO). SoftBank Group Corp and Mitsubishi UFJ Financial Group are acted as financial advisor of the deal.

Kerry Group May Sell its Consumer Foods Business

According to Irish Farmer Journal, Kerry Group Plc, an Ireland-based provider of functional and nutritional solutions to food, beverage, and pharmaceutical industries, may sell its consumer food business. Reportedly, the consumer goods business valued at €1bn ($1.22bn).

Consortium of Investors May Acquire Emerald Kalama Chemical

According to Yahoo Finance, Lanxess AG, a specialty chemicals company, may acquire Emerald Kalama Chemical, a company that offers wide spectrum of material solutions that bring value and performance to consumer and industrial products, for $1bn.

Xiangcai (Harbin High-Tech (Group)) Plans to Raise $912.54m in Non-Public Issuance of A Shares

Xiangcai Co Ltd (formerly Harbin High-Tech (Group) Co. Ltd.), a China-based company involved in soybean deep processing, pharmaceutical production, and property development, has planned to raise CNY6bn ($912.54m) through the non-public issuance of A shares.

Abu Dhabi Developmental Holding (ADQ) to Acquire 45% Stake in Louis Dreyfus

Abu Dhabi Sovereign Wealth Fund (ADQ), a Private Equity fund, has agreed to acquire 45% stake in Louis Dreyfus Company B.V (LDC), the Netherlands-based merchant and processor of agricultural goods, from Margarita Louis-Dreyfus, the chairwoman of Louis Dreyfus Company.

Rhizen signs oncology drug development deal with Curon

Swiss biopharma company Rhizen Pharmaceuticals has signed an exclusive licensing agreement with Curon Biopharmaceutical to develop and commercialise Tenalisib for oncology in the Greater China region. Tenalisib, a highly selective dual PI3K delta and gamma inhibitor, is currently in Phase II clinical development for haematological malignancies. The US FDA granted fast track and orphan drug designations for the drug candidate Tenalisib as a treatment for relapsed/refractory peripheral T-cell lymphoma and cutaneous T-cell lymphoma.