- ECONOMIC IMPACT -

Latest update: 24 March

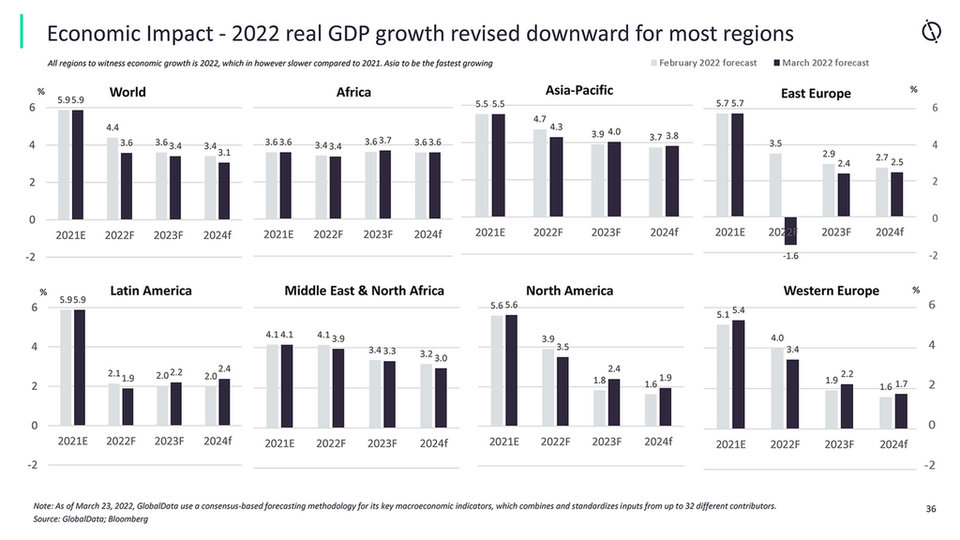

Despite visible green shoots in key macroeconomic indicators in the first half of 2021, the emergence of the Omicron variant of Covid-19 made the global economic recovery increasingly uneven towards the tail end of the year. Although the intensity of the spread of Omicron reduced globally in January and February this year, the ongoing war in Ukraine has dimmed the prospects for a global economic recovery.

GlobalData forecasts the world economy will grow at a slower pace of 3.6% in 2022 following growth of 5.9% in 2021. The global inflation rate, meanwhile, is projected to rise to 5.8% in 2022 (compared to 3.5% last year) as the conflict further fuels commodity prices.

Asia-Pacific is anticipated to be the fastest-growing region in 2022, with the real GDP growth rate forecast at 4.3%, according to GlobalData’s analysis.

However, GlobalData has revised its real GDP growth forecast downward for most regions. The jump in the prices of oil and natural gas has put more upward pressure on an already high inflation rate. The geopolitical tensions also add risk to investments, trade, and consumption demand. Real GDP growth for Asia-Pacific has been revised downward by 0.4 percentage points (pp), eastern Europe by 5.1 pp, western Europe by 0.6 pp and North America by 0.4 pp in March 2022 compared to GlobalData’s earlier projections.

44%

More than four in ten employees report an increase in productivity while they’ve been working from home, according to a GlobalData survey.

43%

The percentage of employees still working at home on a full-time basis, GlobalData research shows. Some 27% of survey respondents said they are now working at the office all week.

All major economies are expected to bounce back in 2021

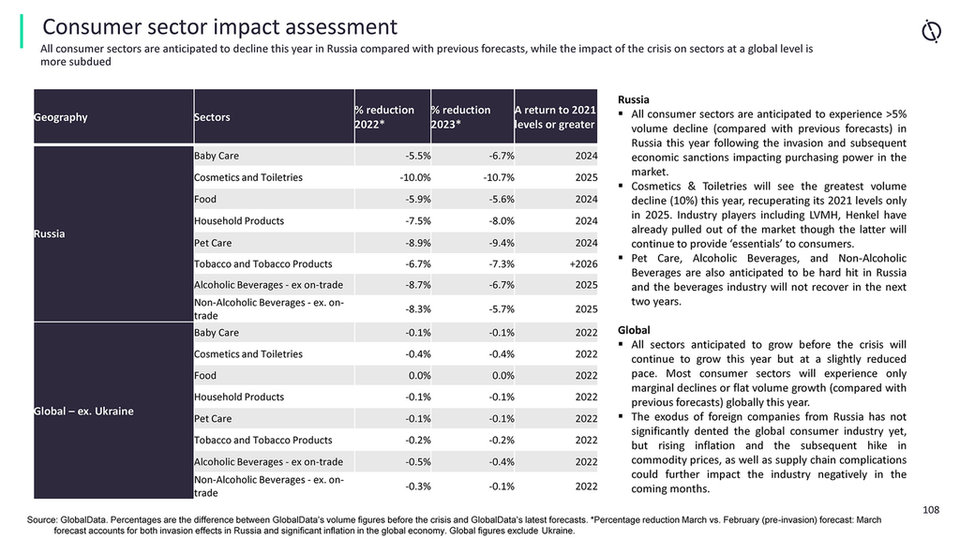

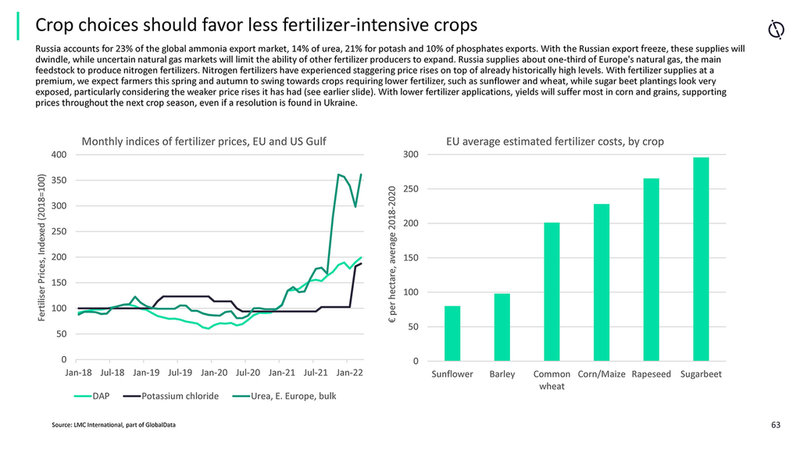

- SECTOR IMPACT: FOOD -

Latest update: 24 March

Agriculture and agri-business impact assessment

This feels like a perfect storm. Exportable supplies of all vegetable oils are down and the only viable short-term solution is to reduce biofuel mandates to free up supplies – and that is unlikely to happen during a fuel price crisis. This leaves high prices to ration demand, supported by the effect of falls in consumer incomes.

Russia accounts for 23% of the global ammonia export market, 14% of urea, 21% of potash, and 10% of phosphates exports. With the Russian export freeze, these supplies will dwindle, while uncertain natural gas markets will limit the ability of other fertilizer producers to expand.

With fertilizer supplies at a premium, we expect farmers this spring and autumn to swing towards crops requiring lower fertilizer, such as sunflower and wheat, while sugar beet plantings look very exposed, particularly considering the weaker price rises the commodity has had. With lower fertilizer applications, yields will suffer most in corn and grains, supporting prices throughout the next crop season, even if a resolution is found in Ukraine.

Any disruption to the planting of spring crops will have potentially serious long-term implications worldwide, in combination with lower yields wherever fertilizer use is cut back. Corn and sunflower would be most affected in Ukraine, as much of the wheat crop was planted last autumn, but sunflower should gain ground in the EU thanks to its low fertilizer requirements.

Higher crude oil prices, and the deepening question of energy security, will increase the support for biofuels. This could preserve high vegetable oil and grain prices for longer than the previous super-cycle in 2012 to 2014.

Trade and financial sanctions will deter some countries from buying commodities from Russia. However, other buyers are likely to step in, which will result in a redirection of trade flows.

FOOD SECTOR TRENDS TO WATCH