DEALS ANALYSIS

Deals activity: South and Central America sees significant decrease in volume; mixed trends across sectors

Powered by

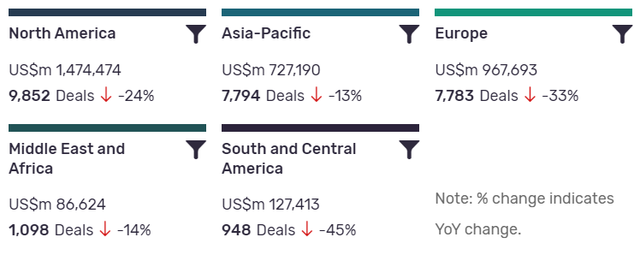

Deals activity by geography

Food industry deals, as captured by GlobalData’s Food Intelligence Centre, are down year-on-year (YoY) across all regions.

North America is leading in terms of deal value, but also recorded a significant decrease in YoY growth in deals volume at -24%. South and Central America, ranking last in terms of deal value, has also suffered the biggest YoY change, with deal volumes at -45%.

The volume of deals recorded by GlobalData also decreased YoY in Middle East and Africa (-14%), Europe (-33%), and Asia-Pacific (-13%).

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Acquisition | 1546977 | 10816 | -7 |

| Asset Transaction | 491646 | 6490 | -60 |

| Venture Financing | 45349 | 2463 | -26 |

| Equity Offering | 245093 | 2264 | 112 |

| Private Equity | 235127 | 1801 | 14 |

| Debt Offering | 642177 | 1559 | 93 |

| Partnership | 852 | 1366 | 43612 |

| Merger | 87419 | 259 | 113 |

A breakdown of deals by type and volume shows mixed trends, with asset transaction down -60%, venture financing down -26% and acquisitions down -7% YoY. However, private equity deals have seen an increase of 14%, debt offering deals are up 93%, equity offerings are up 112% and mergers have increased by 113% YoY. Most notable, however, is the YoY change in partnerships, which are up an astounding 43612%.

Deals activity by sector

The most notable development apparent in GlobalData’s analysis of power industry deals by sector is the decrease of deals across all sectors. Comsumer goods remained the leading sector by deals volume after several strong years of growth and remains relatively stable. Retail, Wholesail and Foodservice saw the largest decline in its total volume, with a drop of roughly 800.

Note: All numbers as of 26 November 2020. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Power Intelligence Centre.

Latest deals in brief

TDR Capital and Issa Brothers to Acquire Asda Stores from Walmart

Walmart Inc., Asda Group Limited, the Issa brothers and TDR Capital announced that the Issa brothers, founders and co-CEOs of EG Group, a convenience and forecourts retailer headquartered in Blackburn, UK, and investment funds managed by TDR Capital LLP, a UK-based private equity firm, have together agreed to acquire Asda, Walmart’s wholly-owned UK supermarket business, for an enterprise value of £6.8bn, on a debt-free and cash-free basis.

Coca-Cola European Partners to Acquire Coca-Cola Amatil for $6.58bn

Coca-Cola European Partners Plc (CCEP), a UK-based bottling company that engages in marketing, production and distribution of Coca-Cola products, has agreed to acquire Coca-Cola Amatil, Ltd. (CCL), an Australia-based manufacturer, distributor and marketer of carbonated and non-carbonated beverages. The transaction is valued at AUD9.23bn ($6.58bn).

Stone Canyon Industries Holdings and Others to Acquire Americas Salt Business (Morton Salt) from K+S

Stone Canyon Industries Holdings LLC, Kissner Group Holdings minority owner and CEO Mark Demetree, and affiliates announced they have entered into an agreement to acquire K+S Aktiengesellschaft's Americas salt business, including Morton Salt, for $3.2bn.

Sanderson Farms Rejects Takeover Offer from Durational Capital for $3.1bn

Sanderson Farms Inc, a company engaged in the production, processing, marketing and distribution of fresh, frozen and minimally prepared chicken, has rejected an unsolicited takeover proposal from Durational Capital Management LP, a private equity firm for $3158.08m. Both entities are based in the US.

Walmart to Sell 85% Stake in Seiyu

Walmart Inc, a US-based retail company, has agreed to sell 85% stake in Seiyu GK, a Japan-based provider of retailing services, to KKR & Co. Inc, a US-based private equity firm and Rakuten, Inc, a Japan-based an e-commerce company, for a purchase consideration of JPY172.5bn (£1.64bn).

Rhizen signs oncology drug development deal with Curon

Swiss biopharma company Rhizen Pharmaceuticals has signed an exclusive licensing agreement with Curon Biopharmaceutical to develop and commercialise Tenalisib for oncology in the Greater China region. Tenalisib, a highly selective dual PI3K delta and gamma inhibitor, is currently in Phase II clinical development for haematological malignancies. The US FDA granted fast track and orphan drug designations for the drug candidate Tenalisib as a treatment for relapsed/refractory peripheral T-cell lymphoma and cutaneous T-cell lymphoma.